KVB e-Book

Description of KVB e-Book

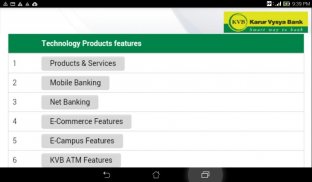

KVB e-Book is a mobile application developed by KVB that allows customers to manage their banking needs conveniently from their Android devices. This app provides users with access to a range of banking services without the need to visit a physical branch, enhancing the overall banking experience. Customers can download KVB e-Book to enjoy features designed for both ease of use and efficiency.

The application includes a variety of functionalities aimed at meeting customers' banking requirements. One primary feature is the ability to check account details. Users can view their account summary, obtain account statements, and track inward cheques directly through the app. This access to real-time account information allows customers to stay updated on their financial status at all times.

In addition to account monitoring, KVB e-Book offers comprehensive deposit details. Customers can view summaries related to their deposits, including the rate of interest applicable to their accounts and detailed statements of their deposits. This feature facilitates better financial planning and enables users to make informed decisions regarding their savings.

Loan management is another significant aspect of the KVB e-Book. Users have the option to review their loan summaries, detailed loan information, and statements. This capability provides customers with a clear understanding of their loan obligations and payment schedules, thereby aiding in effective financial management.

The app also includes several utilities that enhance user convenience. Among these is a recurring deposit and deposit calculator, which helps customers to plan their investments more effectively. Additionally, a loan EMI calculator is available to assist users in calculating their monthly loan repayments. There is also a housing loan eligibility tool, which enables users to determine their eligibility for housing loans based on their financial profiles.

KVB e-Book keeps customers informed about the bank's products and services through timely notifications. Users can receive updates on new offerings and promotional campaigns, ensuring they are aware of the latest options available to them. The app provides a demo of both internet banking and mobile banking, which can help users familiarize themselves with the services offered.

The app has recently made an adjustment to its security measures by replacing the traditional One-Time Password (OTP) with a Mobile Personal Identification Number (MPIN). Customers receive their MPIN on their registered mobile numbers upon their first login. This feature enhances security while also allowing users to reset their MPIN as needed. If a customer forgets their MPIN, there is a retrieval option available, ensuring that access to the app is maintained without unnecessary complications.

Branch and ATM locator features are included to help users find the nearest banking facilities. This is particularly helpful for customers who may need to visit a branch or withdraw cash from an ATM. Furthermore, the app provides a cash remittance limit, allowing customers to manage their transactions efficiently.

Notifications play a vital role in keeping users updated about important banking activities. The app includes features that notify users about uncleared funds and other pertinent account information, ensuring that they remain informed about their financial transactions.

For those looking to request additional banking services, KVB e-Book allows users to request cheque books directly through the app. This feature streamlines the process of obtaining necessary banking materials, reducing the need for in-person visits.

KVB e-Book is designed to simplify banking for its customers by providing a wide range of features that cater to various banking needs. With its emphasis on user convenience, the app allows customers to manage their accounts, loans, and deposits with ease. The ability to access essential banking services anytime and anywhere makes it a valuable tool for modern banking.

The app's functionality is built around providing users with essential information and tools necessary for effective financial management. With its focus on security, ease of access, and a comprehensive set of features, KVB e-Book stands out as a practical solution for customers seeking to manage their banking needs efficiently.

For additional information, customers can log on to www.kvb.co.in or contact customer support at 1860 200 1916.